Roku Stock Price Today Per Share: Comprehensive Analysis and Future Outlook

Roku Inc., a prominent player in streaming technology, has captured considerable attention in the stock market. Investors and analysts regularly monitor Roku stock price today per share to understand its market movements and investment potential. With streaming becoming an integral part of entertainment, Roku has leveraged its position to become a key player in the industry, impacting its stock value.

As of today, Roku stock price per share reflects several market variables, including consumer demand, technological advancements, and competition from other streaming services. Understanding these factors and how they affect the price helps investors make informed decisions about Roku’s market position and the opportunities it presents.

Factors Influencing Roku Stock Price Today Per Share

Multiple elements contribute to the fluctuations in Roku stock price today per share. From economic conditions to company-specific developments, each aspect plays a crucial role in defining the stock’s performance. Economic downturns, for instance, can create volatility, causing stock prices to dip or rise unpredictably. Additionally, quarterly earnings reports, subscriber growth, and innovation can all significantly impact the stock price.

Investor sentiment also has a considerable effect on Roku’s stock price per share. For instance, announcements regarding partnerships with new streaming services, new advertising strategies, or technological upgrades can generate optimism, potentially driving the stock price higher. Conversely, increased competition or unfavorable quarterly reports can impact sentiment negatively, causing fluctuations.

Roku Stock Performance: Historical Data Analysis

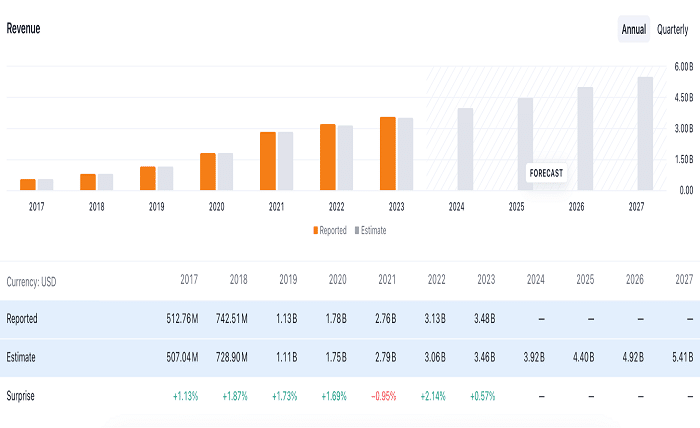

Examining the historical data of Roku stock price today per share provides investors with a clearer picture of the stock’s trajectory and its potential. Roku’s journey in the stock market has been characterized by significant growth, with periods of high volatility. Since its IPO in 2017, Roku has experienced remarkable growth phases along with a few downturns, mostly tied to industry competition and economic shifts.

Historical analysis shows that Roku’s stock tends to spike during periods of high market optimism in the tech industry. Conversely, declines have often occurred during broader market sell-offs or industry-wide concerns about competition. By analyzing these trends, investors can gain insight into how the stock may perform in similar situations in the future.

Roku Stock Price Today Per Share: Comparing with Competitors

Comparing roku stock per share with other companies in the streaming and technology sectors reveals how Roku stands in a competitive market. Key competitors include Netflix, Amazon, and Google, each offering unique streaming solutions. Roku’s differentiator is its focus on hardware for streaming services, in contrast to companies like Netflix, which primarily produces content.

The Roku platform’s value is derived from both hardware sales and advertising revenue, whereas other competitors may rely more heavily on subscription models or other revenue streams. Comparing Roku’s stock price per share to those of its competitors allows investors to evaluate its relative market performance and future growth potential within the industry.

Impact of Earnings Reports on Roku Stock Price Today Per Share

Earnings reports are among the most influential factors affecting Roku stock price today per share. Each quarter, Roku releases its financial performance data, covering revenue, profit margins, and user growth. Positive earnings reports often lead to a spike in Roku’s stock price, as investors gain confidence in the company’s growth trajectory.

Conversely, if Roku underperforms or fails to meet expectations, the stock price may decline. Earnings reports are also important because they provide insights into Roku’s advertising revenue, platform growth, and hardware sales—all essential for determining the company’s market position. Regular monitoring of these reports helps investors gauge the company’s potential for future success.

Roku Stock Price Today Per Share: Analyzing Market Sentiment

Market sentiment plays a crucial role in influencing Roku stock price today per share. Sentiment can be swayed by news, economic conditions, and analyst predictions. If investor sentiment is positive, it can lead to buying pressure, causing Roku’s stock price to rise. Conversely, if there is widespread concern about the stock’s potential, it may result in selling pressure.

Roku’s ability to remain competitive and innovate within the streaming sector directly impacts sentiment. Major developments, such as new platform launches, increased advertising revenue, or partnerships, can boost investor confidence. Conversely, increased competition or missed earnings projections can dampen sentiment and result in decreased stock prices.

Read more about : however synonym

The Role of Technological Advancements on Roku Stock Price Today Per Share

Roku’s position as a leader in streaming is partly due to its continuous adoption of new technology. Innovations in streaming, data analytics, and user experience have contributed to the growth of Roku stock price today per share. With advancements in technology, Roku has been able to expand its offerings, providing a more integrated platform that appeals to both users and advertisers.

Technological advancements have allowed Roku to reach a broader audience and increase its market share. Moreover, its advertising technology has created new revenue streams, further strengthening its stock performance. As Roku continues to innovate, these technological updates are likely to continue influencing the stock’s price positively.

Roku Stock Price Today Per Share: Forecasting Future Trends

Forecasting the future trends of Roku stock price today per share requires an analysis of both market dynamics and company-specific factors. Analysts often use historical data, current market trends, and economic conditions to estimate Roku’s future performance. Trends such as the shift toward streaming services and the growth in digital advertising could support a positive trajectory for Roku’s stock.

Despite positive trends, future forecasts also account for potential challenges, such as increased competition and regulatory concerns. By examining these elements, investors can make more informed predictions about how Roku stock might perform in the coming months or years, helping them decide on potential buy or hold strategies.

Risks Associated with Investing in Roku Stock Price Today Per Share

While Roku presents potential growth opportunities, investing in Roku stock price today per share carries certain risks. Market volatility, competition, and economic fluctuations can all impact Roku’s stock performance. The increasing number of competitors in the streaming space, for instance, poses a constant challenge to Roku’s market position.

Additionally, reliance on advertising revenue means that changes in ad spending trends can affect Roku’s financial performance. Economic downturns and changes in consumer behavior could further add to investment risks. Being aware of these risks is essential for investors looking to make informed decisions about Roku’s stock and its potential for future returns.

Conclusion

Roku stock price today per share offers investors a unique opportunity to invest in the ever-growing streaming industry. With its innovative platform, revenue diversification, and adaptability, Roku has shown potential for sustained growth. However, understanding the factors that influence Roku’s stock performance, including earnings reports, market sentiment, and competitive positioning, is essential before making an investment decision.

While there are risks involved, many investors find Roku’s position in the market appealing, particularly given the industry’s future potential. For those interested in technology and streaming, Roku stock can be a viable option, provided it aligns with their risk tolerance and investment strategy.

FAQs

Q1: How often does Roku stock price today per share change?

A: Roku stock price today per share fluctuates in real time during market hours, affected by trading activities, economic events, and company news.

Q2: Where can I track Roku stock price today per share?

A: Roku stock price today per share can be tracked on financial news platforms, stock exchange websites, and brokerage apps with real-time market data.

Q3: What factors should I consider before investing in Roku stock price today per share?

A: Consider Roku’s market position, earnings reports, historical performance, and competitive landscape when evaluating the stock.

Q4: Does Roku stock price today per share typically rise after earnings reports?

A: If Roku’s earnings reports exceed expectations, the stock price usually rises, but a miss on projections can cause a decrease in price.

Q5: How does competition affect Roku stock price today per share?

A: Increased competition in the streaming industry can impact investor sentiment and put downward pressure on Roku stock price per share.